Indicators on Fortitude Financial Group You Should Know

Indicators on Fortitude Financial Group You Should Know

Blog Article

The smart Trick of Fortitude Financial Group That Nobody is Discussing

Table of ContentsFacts About Fortitude Financial Group UncoveredFortitude Financial Group Can Be Fun For AnyoneRumored Buzz on Fortitude Financial GroupThe Best Guide To Fortitude Financial GroupThe Definitive Guide for Fortitude Financial Group

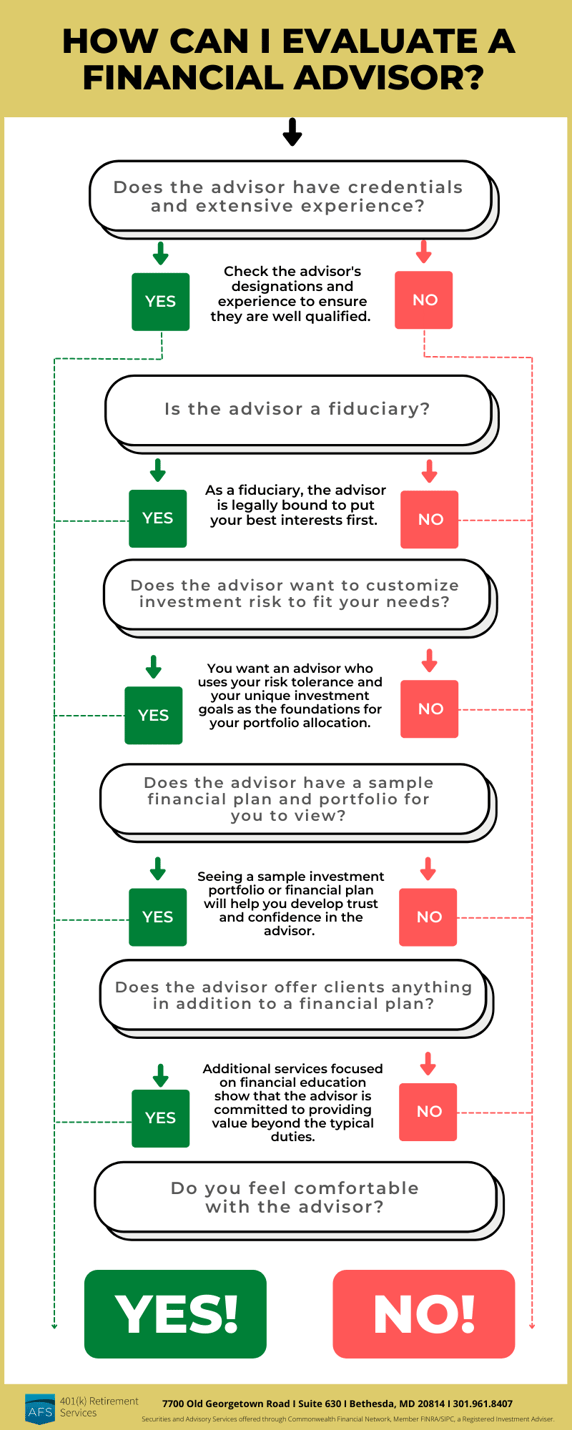

Keep in mind that several advisors won't manage your properties unless you meet their minimal needs (Investment Planners in St. Petersburg, Florida). This number can be as low as $25,000, or get to right into the millions for the most special consultants. When picking an economic consultant, figure out if the specific adheres to the fiduciary or suitability standard. As kept in mind earlier, the SEC holds all consultants signed up with the agency to a fiduciary requirement.The broad field of robos covers systems with accessibility to economic experts and financial investment administration. If you're comfortable with an all-digital system, Wealthfront is an additional robo-advisor choice.

You can locate a financial advisor to aid with any type of facet of your economic life. Financial consultants might run their very own company or they could be component of a larger office or financial institution. No matter, a consultant can aid you with whatever from building a financial plan to spending your money.

Some Known Factual Statements About Fortitude Financial Group

Examine that their credentials and skills match the services you want out of your expert. Do you want to find out even more about financial advisors?, that covers principles surrounding accuracy, reliability, content independence, competence and neutrality.

Many individuals have some emotional link to their cash or things they acquire with it. This emotional connection can be a main factor why we may make bad monetary decisions. A specialist monetary expert takes the emotion out of the equation by offering objective suggestions based upon understanding and training.

As you undergo life, there are economic choices you will certainly make that could be made much more conveniently with the guidance of an expert. Whether you are attempting to decrease your debt lots or wish to begin preparing for some long-lasting objectives, you might benefit from the services of an economic advisor.

Fortitude Financial Group for Beginners

The essentials of financial investment monitoring include purchasing and offering economic possessions and various other investments, yet it is extra than that. Handling your financial investments includes comprehending your brief- and long-lasting objectives and using that information to make thoughtful investing choices. A monetary consultant can supply the data necessary to help you expand your investment profile to match your desired degree of threat and fulfill your monetary goals.

Budgeting provides you an overview to just how much cash you can invest and exactly how much you must conserve monthly. Complying with a budget will certainly help you reach your brief- and lasting monetary objectives. A monetary consultant can aid you lay out the activity steps to require to establish and maintain a budget that benefits you.

Occasionally a clinical costs or home fixing can suddenly contribute to your financial debt tons. A specialist debt monitoring plan helps you repay that debt in the most monetarily beneficial means possible. An economic advisor can aid you evaluate your financial debt, prioritize a debt settlement strategy, give options for financial debt restructuring, and outline a holistic strategy to much better manage debt and satisfy your future financial goals.

Our Fortitude Financial Group Diaries

Personal capital evaluation can tell you when you can pay for to purchase a new auto or just how much cash you can add to your cost savings each month without running short for necessary expenditures (Financial Advisor in St. Petersburg). An economic advisor can aid you plainly visit this page see where you spend your money and after that apply that understanding to aid you recognize your economic wellness and exactly how to boost it

Danger administration services recognize possible threats to your home, your vehicle, and your family, and they aid you place the appropriate insurance plan in position to minimize those threats. A financial consultant can assist you develop a technique to shield your making power and reduce losses when unforeseen points take place.

Fortitude Financial Group Fundamentals Explained

Decreasing your taxes leaves more cash to contribute to your investments. Financial Resources in St. Petersburg. An economic consultant can help you use philanthropic providing and investment strategies to decrease the quantity you should pay in tax obligations, and they can show you how to withdraw your cash in retirement in a way that likewise reduces your tax obligation worry

Even if you didn't start early, university planning can aid you place your kid through university without encountering suddenly large expenditures. A financial consultant can lead you in understanding the best ways to save for future college expenses and just how to money potential spaces, describe just how to reduce out-of-pocket college prices, and suggest you on eligibility for financial assistance and gives.

Report this page